NDIS Quarterly Report Q2 2024-25: SDA Growth and Key Outcomes

The NDIS Quarterly Report for Q2 2024-25, out on February 14, 2025, digs into how the scheme is shaping up—think housing, money, and people’s lives. It tracks Specialist Disability Accommodation (SDA) growth, with 10,749 dwellings now enrolled, up 2,159 from last year. Spending reached $22.9 billion, $390 million less than expected, hinting at tighter control.

This article breaks down the latest NDIS quarterly reports to show what’s working: more SDA options, better participant outcomes, and a crackdown on fraud. It’s a practical look for investors and providers watching the numbers.

Read also: Identifying Key Growth Areas in SDA Housing by 2027

Housing on the Rise

According to the NDIS quarterly report, SDA dwellings have risen to 10,749, marking an increase of 2,159 from the previous year. Robust SDA demand saw a 60% growth, while High Physical Support (HPS) grew by 45%. The key takeaway here is the growing need for single-tenant homes in the Robust category. This shift is driven by a recognition that many Robust participants require their own space rather than sharing.

As for SDA funding, $517 million has been allocated, but only $382 million has been drawn. The delay in spending is mainly due to around 16,000 participants still in legacy or group homes. These participants account for the lower average SDA payment of $27,500 per person. For new builds, the payment is significantly higher, around $50,000 to $60,000 per participant. However, the transition from legacy or existing funding to new builds can take months, meaning investors may face some delays in fully capturing returns.

So, as an investor, don’t ditch an applicant stuck on existing rates—they’ll get there, and vacancies don’t fill overnight. Reject them, and providers might pass over your property next time. Patience pays off here.

Financial Trends and Stability

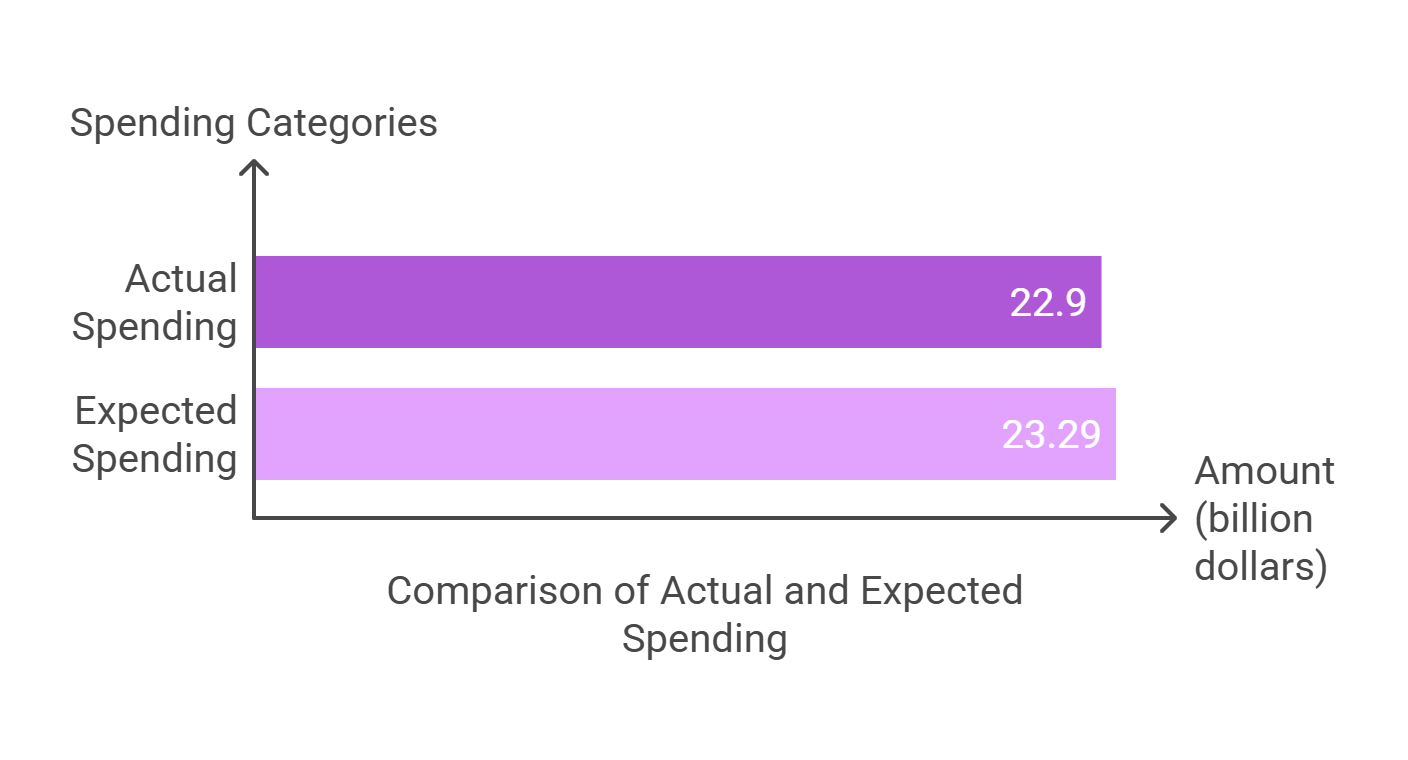

The NDIS Quarterly Report highlights a spending total of

$22.9 billion for the 6 months to December 2024, which is $390 million below the expected figure. This is a positive sign, indicating better cost management, as the growth rate has slowed to 11.9%, on track to meet the 8% growth target by 2026-27. The scheme is expected to underspend by $600 million this year, which signals a tightening of financial controls.

This financial stability has largely come from the implementation of stricter regulations, including new laws introduced in October 2024. These regulations aim to limit fraudulent claims and improve the overall integrity of the system, though they have led to some funding cuts. While these cuts have created challenges for some participants, they contribute to long-term financial health for the NDIS.

For SDA properties, the average funding is $27,500 per participant (which interestingly has increased by 35% over the 12-month period). However, the shift towards new builds, which provide higher payments of $50,000 to $60,000 per participant, is continuing. This transition process is slow, so investors must plan for potential delays when expecting full returns on their SDA investments.

Participant Outcomes Improving

The NDIS Quarterly Report showcases positive outcomes for participants. After two years in the scheme, 43% of participants report increased community engagement, meaning they’re getting more involved in social activities and events. For younger participants, those aged 15-24, the employment rate has more than doubled, climbing from 10% to 23%.

Family carers have also benefited, with paid employment among carers rising from 47% to 52%. Additionally, 80% of participants who have been in the NDIS for over two years now feel they have more choice and control over their lives, compared to just 67% when they first entered the program. These improvements, though gradual, signal a positive trend for participants. The NDIS is delivering tangible benefits, including better social inclusion, increased employment opportunities, and more autonomy for those in the program.

Read also:

Finding the Right Tenant for Your NDIS SDA Investment

Fraud Prevention and Service Gains: Is the NDIS Finally Cleaning House?

The NDIS is making progress in stopping fraud and keeping a closer watch on providers. The report shows that $10.4 million has been invested in fraud detection. It also found that over 15,000 participants were affected by fraudulent providers. These participants are now being moved to safer and more reliable care, which helps protect both them and the NDIS system.

- 74% of complaints are now resolved within 21 days, a sharp rise from 54%.

- 800 additional frontline staff onboarded to reduce processing delays.

- Automatic participant plan extensions prevent funding gaps and service disruptions.

For SDA investors, faster approvals are a positive step, but stricter rules mean more checks on tenant applications. Many participants still depend on old group home funding, which requires a change-of-circumstances approval to get higher SDA payments. This process can take several months, so investors need to plan for possible delays before seeing full returns.

What It Means for Investors

The NDIS Quarterly Report paints a promising, yet cautious outlook for SDA investors. The number of SDA homes continues to rise, but the slow transition to new builds and delays to upgrade funding are hurdles that must be considered. While the SDA market holds potential, investors need to be strategic about where they buy and who they rent to.

- Demand for Robust SDA is on the rise, with a 60% increase in enrolments.

- The High Physical Support (HPS) category saw a 45% increase, though some areas remain oversupplied.

- Lending policies have tightened, and site selection is important.

In addition to these trends, there are still risks of oversupply, especially in outer metro areas. Postcodes beyond 15-35 km from CBDs (depending on the city) are now blacklisted for lending by the main NDIS lender. Investors need to stay informed about these restrictions to avoid investing in areas with low demand.

Are you an investor in need of real market data?

The NDIS housing investment market is still full of potential, but careful planning is more important than ever. SDA approvals, funding transitions, and lending restrictions.

NDIS Property Australia provides detailed SDA investment reports to help investors make informed decisions. For

$660, get an SDA demand and viability report.

You might also like

Navigation

Services

Disclaimer: NDIS PROPERTY AUSTRALIA, a subsidiary of BUILD NEW HOMES AUSTRALIA (Corporate Real Estate License QLD (#4417552), NSW (#10121176), VIC (#89760L) & WA (RA82210), has prepared information on this website that is general in nature. We believe this information to be reliable and accurate, based on currently available data. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider your financial situation and needs before making any decisions based on this information. NDIS PROPERTY AUSTRALIA, its subsidiaries, affiliates and consultants, are not licensed financial advisors and are not liable to any person or entity for any damage or loss that has occurred, or may occur, in relation to that person or entity taking or not taking action in respect of any representation, statement, opinion or advice referred to herein. You should seek independent professional legal, taxation and finance advice.

Acknowledgement: NDIS PROPERTY AUSTRALIA acknowledges Traditional Owners of Australia. We pay our respects to Aboriginal and Torres Strait Islander Elders past, present, and future.

All Rights Reserved | NDIS PROPERTY AUSTRALIA